Work in progress

- Importing Intermediates & Pass-Through: The Extensive Margin

Presentations: Dauphine Doctoral Retreat (2024), Dauphine PhD Workshop (2024), Columbia ITS Colloquium (2025, scheduled)

- Inflation in Distorted Economies: Evidence from India

joint with Juan Herreño and Noémie Pinardon-Touati

- Importing Intermediates & Pass-Through: The Extensive Margin

Presentations: Dauphine Doctoral Retreat (2024), Dauphine PhD Workshop (2024), Columbia ITS Colloquium (2025, scheduled)

- Inflation in Distorted Economies: Evidence from India

joint with Juan Herreño and Noémie Pinardon-Touati

Policy Papers

joint with Axelle Arquié, 2023.

also available as IMK working paper

Award: New Paradigm Paper of the Month of July

Media Coverage: Alternatives Économiques, Les Echos

Abstract ▼

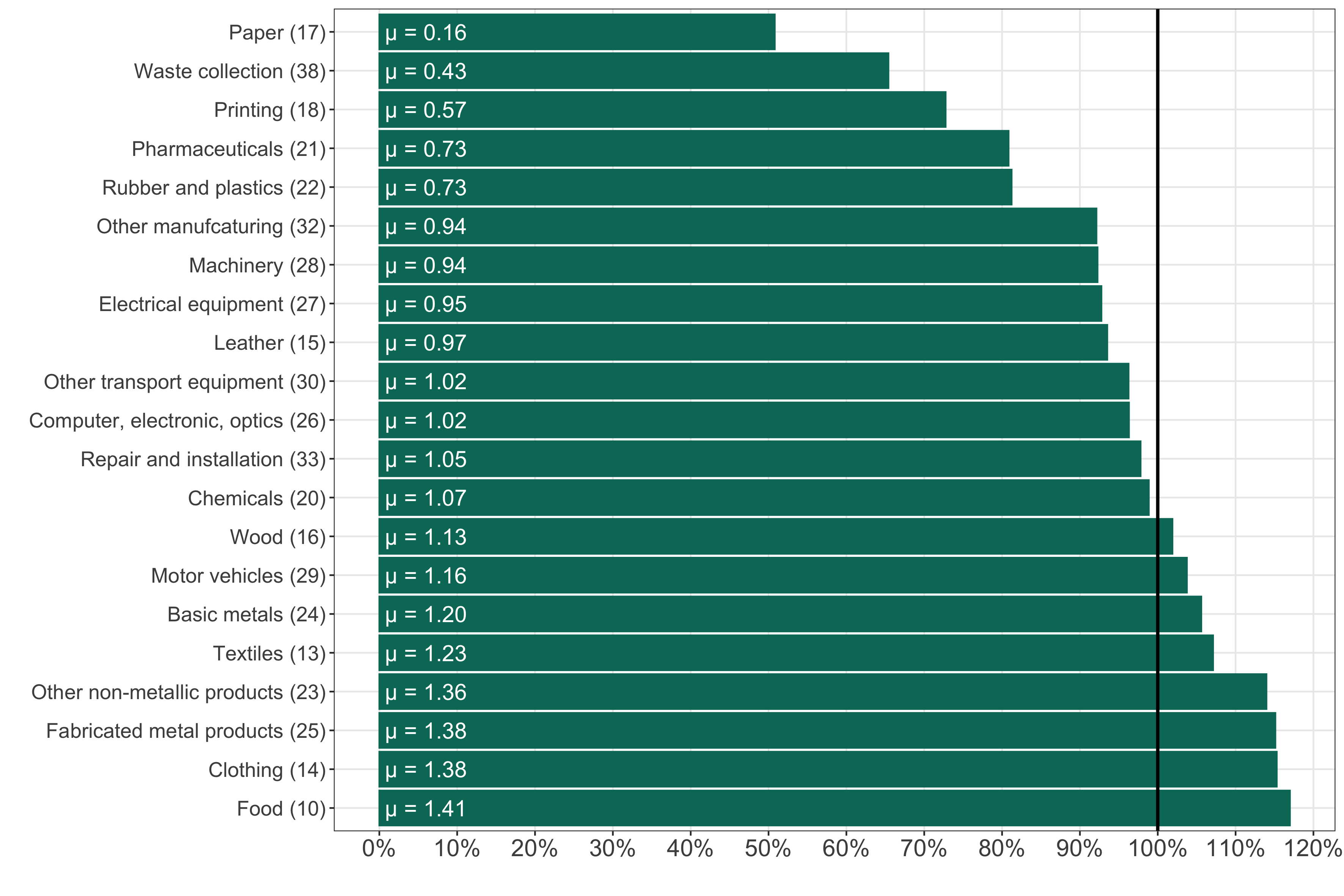

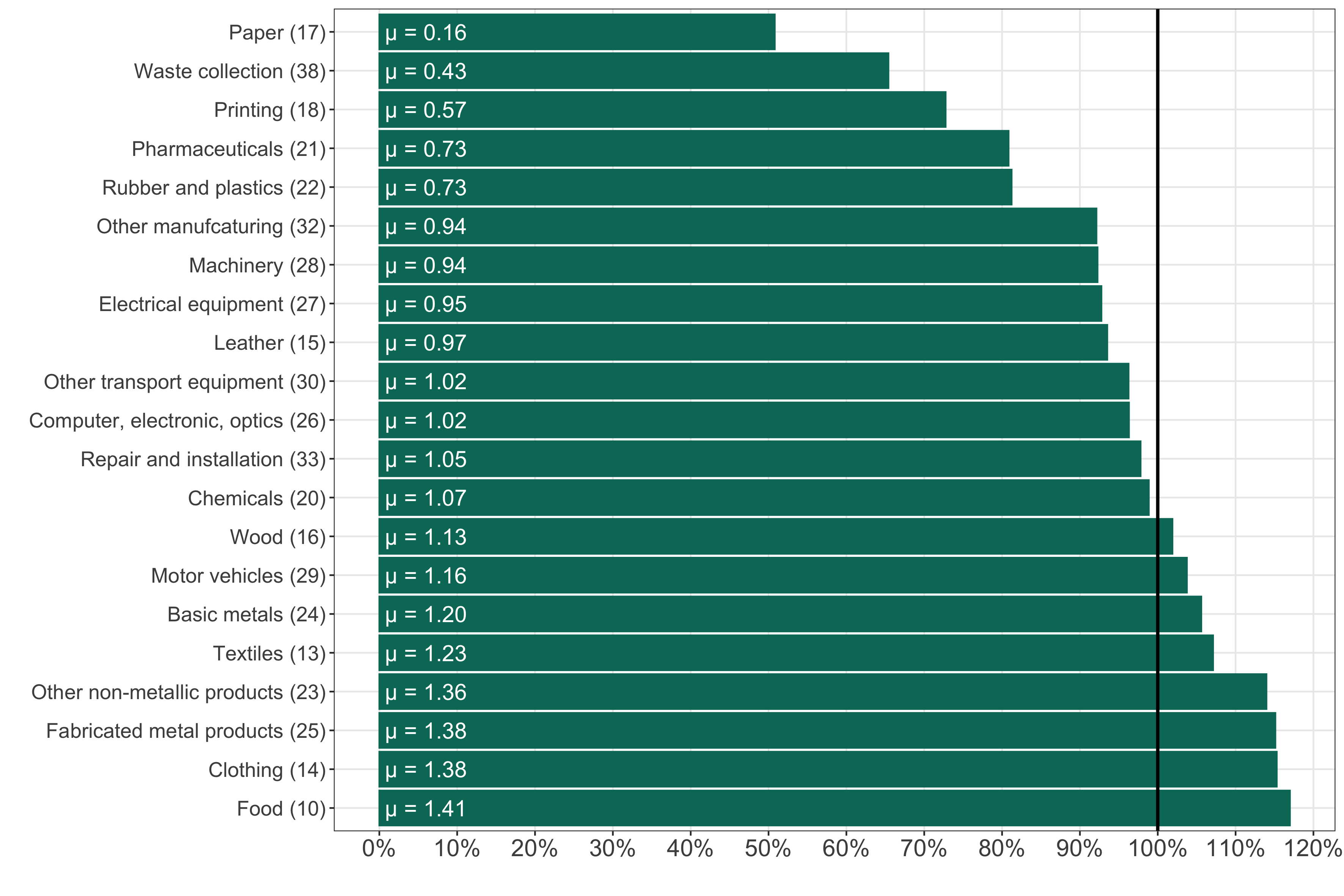

We explore how, in the French manufacturing sector, producer prices vary with market power during a severe episode of energy price hikes (between January 2020 and February 2023). Our work provides some empirical evidence in favor of a role for firms' market power in explaining inflation, and in favor of the "sellers' inflation'' hypothesis (Weber and Wasner, 2023): in less competitive sectors, firms could use the energy price hike to increase their prices more than warranted by actual changes in costs. Using a rich dataset on French manufacturing firms' balance sheets, we first estimate markups at the firm-level, and aggregate them at the sectoral level. We then study the response of the producer price index (PPI) to a change in spot energy prices, depending on average market power within sectors. We show that, in sectors with higher markups, prices increase relatively more: in the least competitive sector, firms pass through up to 110% of the energy shock, implying an excess pass-through of 10 percentage points. In addition, we find that the association between markup and pass-through is even higher when markup dispersion is low, consistent with the argument that firms engage in price hikes when they expect their competitors to do the same.

also available as IMK working paper

Award: New Paradigm Paper of the Month of July

Media Coverage: Alternatives Économiques, Les Echos

We explore how, in the French manufacturing sector, producer prices vary with market power during a severe episode of energy price hikes (between January 2020 and February 2023). Our work provides some empirical evidence in favor of a role for firms' market power in explaining inflation, and in favor of the "sellers' inflation'' hypothesis (Weber and Wasner, 2023): in less competitive sectors, firms could use the energy price hike to increase their prices more than warranted by actual changes in costs. Using a rich dataset on French manufacturing firms' balance sheets, we first estimate markups at the firm-level, and aggregate them at the sectoral level. We then study the response of the producer price index (PPI) to a change in spot energy prices, depending on average market power within sectors. We show that, in sectors with higher markups, prices increase relatively more: in the least competitive sector, firms pass through up to 110% of the energy shock, implying an excess pass-through of 10 percentage points. In addition, we find that the association between markup and pass-through is even higher when markup dispersion is low, consistent with the argument that firms engage in price hikes when they expect their competitors to do the same.

Other publications

La Lettre du CEPII - Oct. 2023; with Axelle Arquié

Le Blog du CEPII - 26.06.2022; with Axelle Arquié

La Lettre du CEPII - Dec. 2022; with Cecilia Bellora

Le Blog du CEPII - 10.04.2022; with Cecilia Bellora and Kevin Lefebvre

(also available in French on The Conversation)

Le Blog du CEPII - 04.04.2022; with Cecilia Bellora and Pierre Cotterlaz(also available in French)